Authors: Yiluan Xing, Chao Yan, Cathy Chang Xie

Published on: May 14, 2024

Impact Score: 7.0

Arxiv code: Arxiv:2405.08284

Summary

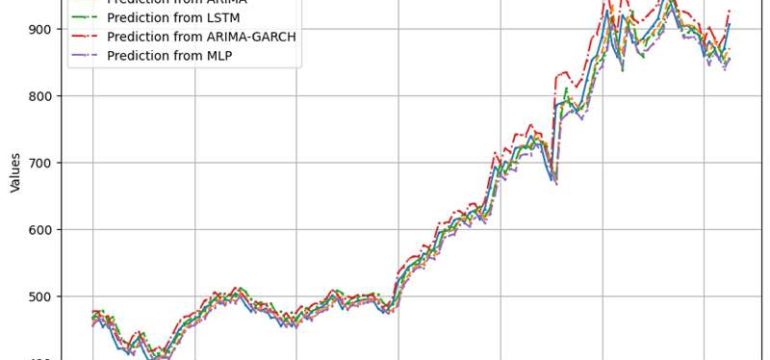

- What is new: This study introduces an advanced machine learning model specifically tuned for forecasting NVIDIA stock prices, incorporating both historical data trends and real-time market sentiments.

- Why this is important: Accurately predicting stock prices is a complex challenge due to the volatile nature of the markets and the amount of influencing factors.

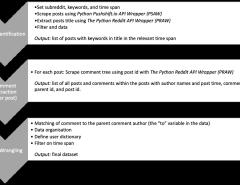

- What the research proposes: The research proposes a novel AI-powered model that integrates deep learning and natural language processing to predict stock prices based on past data and current market conditions.

- Results: The model demonstrated a higher forecast accuracy compared to traditional models, particularly in predicting short-term price fluctuations accurately.

Technical Details

Technological frameworks used: TensorFlow and PyTorch for deep learning, NLTK for natural language processing

Models used: Convolutional Neural Networks (CNNs), Long Short-Term Memory networks (LSTMs), and BERT-based sentiment analysis

Data used: Historical stock prices, financial news articles, and social media sentiments

Potential Impact

This research can significantly affect financial analysts, hedge funds, and retail investment platforms, potentially offering them a technological edge in market predictions.

Want to implement this idea in a business?

We have generated a startup concept here: AIVestor.

Leave a Reply