Authors: Dimitris Bertsimas, Cynthia Zeng

Published on: May 11, 2024

Impact Score: 8.2

Arxiv code: Arxiv:2405.07068

Summary

- What is new: First application of Adaptive Robust Optimization (ARO) to disaster insurance pricing.

- Why this is important: Increasing frequency and severity of natural disasters require better methods for calculating insurance premiums.

- What the research proposes: Introduction of an ARO framework that incorporates both historical and emerging risks predicted by machine learning to calculate catastrophe insurance premiums.

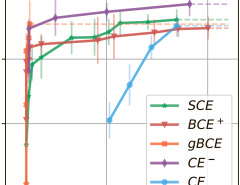

- Results: The ARO models effectively covered losses and produced surpluses with a conservative parameter set, showing fewer insolvencies and lower premiums.

Technical Details

Technological frameworks used: Adaptive Robust Optimization (ARO)

Models used: Machine learning models for predicting emerging risks

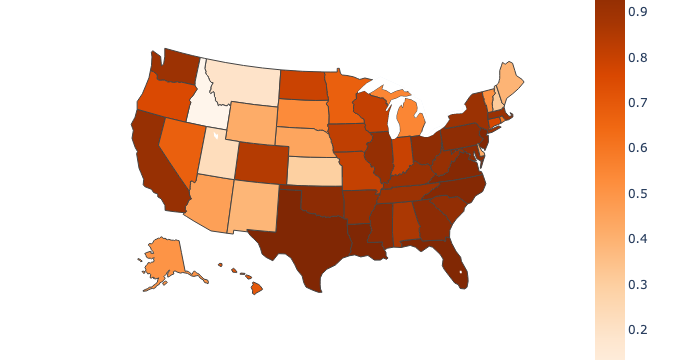

Data used: US National Flood Insurance Program data

Potential Impact

Insurance companies, particularly those focusing on natural disaster coverage; could benefit policymakers and stakeholders involved in managing natural disaster risks.

Want to implement this idea in a business?

We have generated a startup concept here: ClimaCover.

Leave a Reply