Authors: Phoebe Jing, Yijing Gao, Xianlong Zeng

Published on: April 23, 2024

Impact Score: 8.0

Arxiv code: Arxiv:2404.14746

Summary

- What is new: Introduction of a benchmark containing structured datasets designed for customer-level fraud detection, focusing on privacy-compliant, comprehensive data.

- Why this is important: Lack of comprehensive and privacy-compliant datasets for customer-level fraud detection hampers the development of effective predictive models.

- What the research proposes: A new benchmark with structured datasets tailored for customer-level fraud detection, adhering to privacy guidelines and providing customer-centric features.

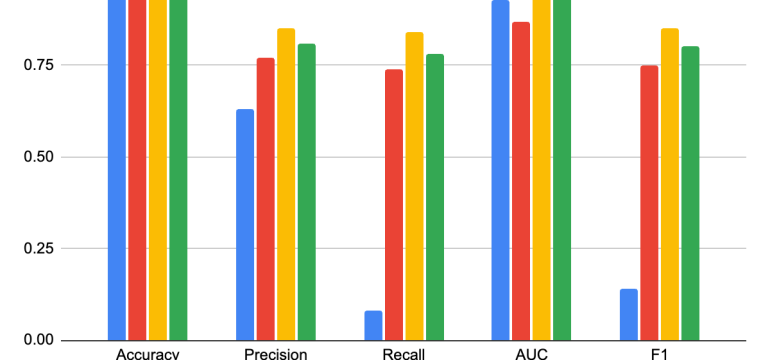

- Results: Facilitates a comprehensive evaluation of machine learning models for fraud detection, enhancing understanding of models’ predictive capabilities.

Technical Details

Technological frameworks used: nan

Models used: Various machine learning models

Data used: Structured datasets with customer-centric features for fraud detection

Potential Impact

Financial institutions, online marketplaces, and any company involved in processing large volumes of transactions could benefit or be disrupted.

Want to implement this idea in a business?

We have generated a startup concept here: FraudGuard AI.

Leave a Reply