Authors: Morteza Maleki

Published on: April 16, 2024

Impact Score: 7.6

Arxiv code: Arxiv:2404.10208

Summary

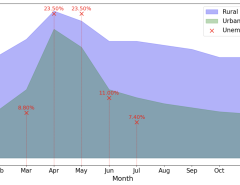

- What is new: This study introduces a novel approach by combining machine learning techniques with an enriched dataset of macroeconomic indicators and market data to predict downturns in the tech sector specifically.

- Why this is important: The challenge in predicting stock price movements, particularly identifying major downturns in the Information Technology Sector.

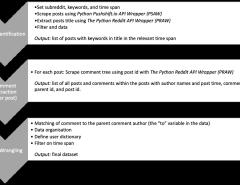

- What the research proposes: A combination of multiple regression and logistic regression analysis on historical stock prices, technical indicators, and macroeconomic data to forecast significant downturns.

- Results: The models were able to identify patterns that predict sector-specific downturns, improving investment strategies by anticipating market volatility.

Technical Details

Technological frameworks used: Machine learning

Models used: Multiple regression analysis, logistic regression

Data used: Macroeconomic indicators, market data

Potential Impact

Portfolio management, investment firms, and companies within the GICS Information Technology Sector could benefit or be disrupted by these predictive insights.

Want to implement this idea in a business?

We have generated a startup concept here: TechTrendPredictor.

Leave a Reply