Authors: Thanos Konstantinidis, Giorgos Iacovides, Mingxue Xu, Tony G. Constantinides, Danilo Mandic

Published on: March 18, 2024

Impact Score: 7.6

Arxiv code: Arxiv:2403.12285

Summary

- What is new: Introduces FinLlama, a finance-specific LLM framework fine-tuned on financial sentiment analysis data, incorporating a novel generator-classifier scheme for nuanced insight into financial news.

- Why this is important: Existing sentiment analysis models lack context sensitivity and efficiency in processing financial information, affecting trading decisions.

- What the research proposes: A finance-specific LLM, FinLlama, fine-tuned on financial data and equipped with a neural network based decision mechanism to accurately analyze financial sentiments.

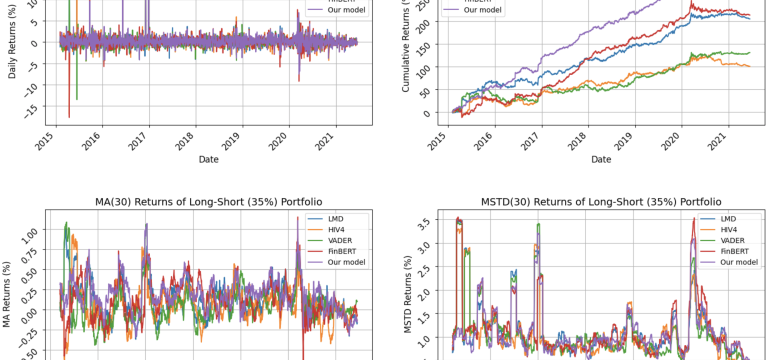

- Results: FinLlama enhances portfolio management decisions and enables the construction of high-return, resilient portfolios, showing promise in simulation results.

Technical Details

Technological frameworks used: Llama 2 7B foundational model, LoRA for parameter-efficient fine-tuning

Models used: Neural network based decision mechanism, generator-classifier scheme

Data used: Supervised financial sentiment analysis data

Potential Impact

Financial trading platforms, investment firms, and financial news aggregation services could benefit or face disruption due to enhanced trading decision capabilities.

Want to implement this idea in a business?

We have generated a startup concept here: MarketMood.

Leave a Reply