Authors: Xiangyu Li, Xinjie Shen, Yawen Zeng, Xiaofen Xing, Jin Xu

Published on: March 05, 2024

Impact Score: 7.2

Arxiv code: Arxiv:2403.02647

Summary

- What is new: The introduction of FinReport, an automatic system designed for ordinary investors to efficiently collect information, analyze it, and generate professional-level reports on stock earnings forecasting.

- Why this is important: Ordinary investors find it challenging to mine factors and analyze news for stock earnings forecasting compared to financial institutions.

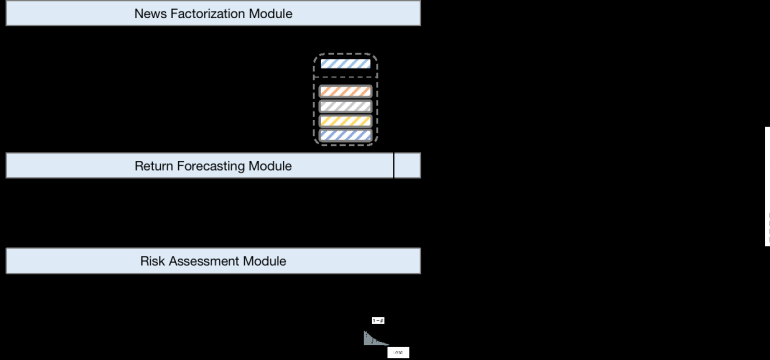

- What the research proposes: FinReport, utilizing financial news announcements and a multi-factor model distributed across three modules for news factorization, return forecasting, and risk assessment to enhance user experience without requiring deep financial knowledge.

- Results: Extensive experiments on real-world datasets confirmed FinReport’s effectiveness and explainability in generating accurate and professional stock earnings forecasts.

Technical Details

Technological frameworks used: FinReport consists three modules: news factorization, return forecasting, and risk assessment.

Models used: Multi-factor model combined with large language models for analyzing financial news.

Data used: Real-world financial news announcements and datasets for training and testing.

Potential Impact

Financial technology services, investment tools for retail investors, and potentially traditional financial advisory services could be disrupted or benefit from the adoption of FinReport’s insights.

Want to implement this idea in a business?

We have generated a startup concept here: FinInsight.

Leave a Reply