CausaFi

Elevator Pitch: In today’s volatile financial markets, traditional risk management tools falter when you need them most. CausaFi leverages cutting-edge research to predict and mitigate risks using a novel causal network approach, ensuring your investments are protected even in the face of unforeseen market shocks. Stay ahead of the game with CausaFi’s superior analytics.

Concept

Risk Management Analytics Platform

Objective

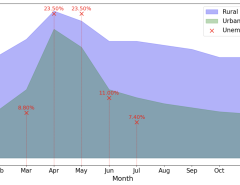

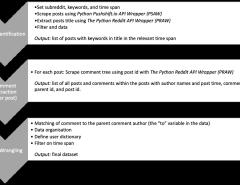

To revolutionize financial risk management by implementing the Causal Network Contagion Value at Risk (Causal-NECO VaR) methodology.

Solution

CausaFi provides a platform leveraging the Causal-NECO VaR method for robust, predictive risk analysis in finance, capturing volatility and spillover effects to offer advanced risk assessments.

Revenue Model

Subscription-based for financial institutions, pay-per-report for smaller firms, and consultancy services for custom risk management solutions.

Target Market

Financial institutions, hedge funds, investment banks, independent traders, and regulatory bodies.

Expansion Plan

Initially focus on the Forex market, then expand to stocks, commodities, and cryptocurrencies. Scale by entering new geographical markets and broadening our analytics offerings.

Potential Challenges

Complexity in explaining the methodology to non-experts, integration with existing financial systems, and continuous data acquisition and processing.

Customer Problem

Traditional risk management methods fail to accurately predict and mitigate financial risk in volatile markets.

Regulatory and Ethical Issues

Compliance with global financial regulations, ensuring data privacy and protection, and ethical use of predictive analytics.

Disruptiveness

CausaFi’s use of causal networks for risk analysis is a significant leap from correlation-based methods, offering superior predictions that could redefine financial risk management standards.

Leave a Reply