FairLend

Elevator Pitch: FairLend revolutionizes lending by ensuring that getting a loan is fair for everyone. Leveraging cutting-edge AI, we analyze and optimize lending models to eliminate bias, making sure that loan approvals and rates are based on your true creditworthiness, not your background. For lenders, we offer a way to balance fairness with financial performance, ensuring compliance and enhancing customer trust. Join FairLend and be at the forefront of ethical lending.

Concept

An AI-driven platform enhancing fairness in credit scoring by optimizing the fairness-performance trade-off while ensuring high forecasting accuracy.

Objective

To provide a lending platform that uses an advanced AI algorithm to ensure fairness in credit scoring, minimizing discrimination against protected attributes while maintaining high forecasting accuracy.

Solution

Incorporate a proprietary AI algorithm that formally tests and optimizes the fairness-performance trade-off in credit scoring models, identifying and correcting biases.

Revenue Model

Subscription fees from lending institutions for access to the AI platform and consulting services for regulatory compliance and fairness optimization.

Target Market

Financial institutions, credit scoring agencies, and fintech companies seeking to enhance fairness in their lending processes.

Expansion Plan

Initially target domestic lenders, with plans to expand globally by adapting the algorithm to comply with regional regulatory standards and fairness needs.

Potential Challenges

Ensuring the complexity of the algorithm does not significantly impact the speed of credit decision processes, and maintaining adaptability to evolving definitions of fairness and discrimination.

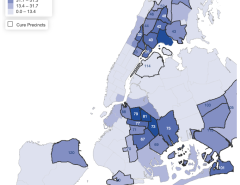

Customer Problem

Discrimination in credit scoring against individuals with protected attributes, leading to unfair loan denials or unfavorable lending terms.

Regulatory and Ethical Issues

Compliance with local and international regulations on credit lending and anti-discrimination laws. Commitment to continuous monitoring and adjustment of the fairness criteria.

Disruptiveness

Shifts the lending industry towards more equitable practices by providing a tool that aligns fairness with financial performance, potentially setting a new standard for ethical lending.

Leave a Reply