Authors: Erdong Chen, Mengzhong Ma, Zixin Nie

Published on: February 06, 2024

Impact Score: 8.22

Arxiv code: Arxiv:2402.03953

Summary

- What is new: This study pioneers an analytical framework tailored for investigating trader behavior on perpetual future contracts, emphasizing blockchain’s role.

- Why this is important: Understanding how traders behave on perpetual future contracts across CEXs and DEXs in response to price volatility.

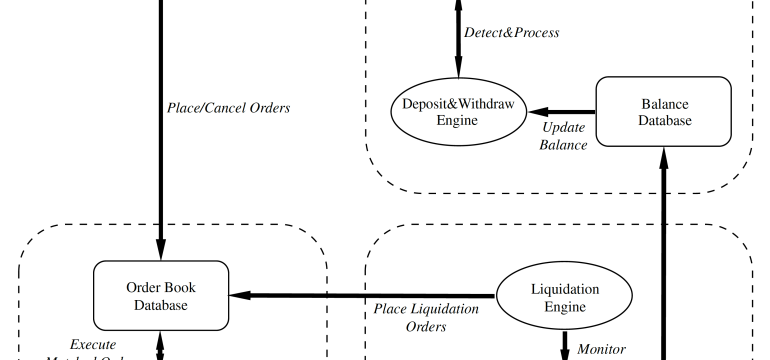

- What the research proposes: A new Systematization of Knowledge (SoK) approach, integrating detailed analysis of trader dynamics on both CEXs and DEXs.

- Results: Identified unique trader behaviors in DEX environments; in VAMM DEXs, open interests impact price volatility oppositely, while Oracle Pricing DEXs exhibit buyer-seller asymmetries.

Technical Details

Technological frameworks used: Systematization of Knowledge (SoK)

Models used: Virtual Automated Market Making (VAMM), Oracle Pricing

Data used: Historical data from CEXs, Transactional data from DEXs

Potential Impact

This research could impact DeFi platforms, traditional finance institutions exploring blockchain integration, and companies developing blockchain-based trading solutions.

Want to implement this idea in a business?

We have generated a startup concept here: DeFi Dynamics.

Leave a Reply