Authors: Marc Schmitt

Published on: February 06, 2024

Impact Score: 8.27

Arxiv code: Arxiv:2402.03806

Summary

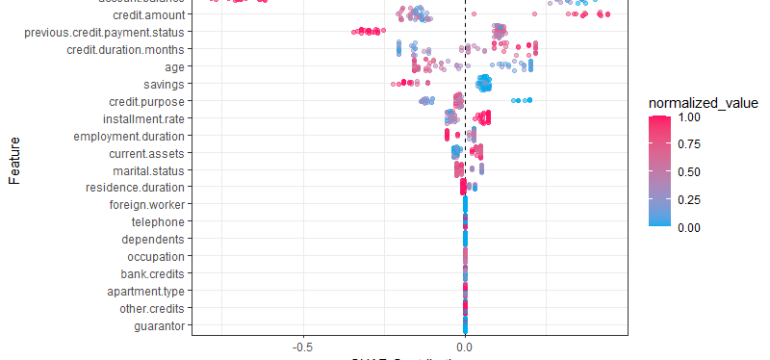

- What is new: This paper introduces the integration of Explainable Automated Machine Learning (AutoML) for credit decision-making in financial engineering, emphasizing the use of SHapley Additive exPlanations (SHAP) for transparency.

- Why this is important: The challenge in the finance industry to balance sophisticated AI-driven decision-making with the need for transparency and trust.

- What the research proposes: Implementing a combination of AutoML to streamline model development and XAI methods, specifically SHAP, to make AI decisions in finance understandable and accountable.

- Results: The study showed that explainable AutoML enhances the efficiency and accuracy of credit decisions while also improving transparency and trust in AI systems among users.

Technical Details

Technological frameworks used: AutoML, XAI

Models used: SHapley Additive exPlanations (SHAP)

Data used: Credit scoring data

Potential Impact

Financial institutions, credit scoring companies, fintech startups

Want to implement this idea in a business?

We have generated a startup concept here: ClearCredit AI.

Leave a Reply