Authors: Saizhuo Wang, Hang Yuan, Lionel M. Ni, Jian Guo

Published on: February 06, 2024

Impact Score: 8.07

Arxiv code: Arxiv:2402.03755

Summary

- What is new: Introduces a principled framework for integrating domain-specific knowledge bases into LLMs, focusing on financial trading.

- Why this is important: Efficiently incorporating specialized knowledge into autonomous agents for tasks like quantitative investment is challenging.

- What the research proposes: A two-layered approach where the agent refines responses using a knowledge base and enhances its knowledge through real-world testing.

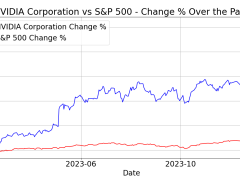

- Results: QuantAgent demonstrates improved financial forecasting accuracy and the ability to uncover viable trading signals.

Technical Details

Technological frameworks used: Two-layered approach for knowledge integration and testing

Models used: Large Language Models (LLMs)

Data used: Financial data for mining trading signals

Potential Impact

Quantitative investment firms, financial analysts, and fintech companies

Want to implement this idea in a business?

We have generated a startup concept here: QuantLeap.

Leave a Reply