Authors: Georgios Fatouros, Konstantinos Metaxas, John Soldatos, Dimosthenis Kyriazis

Published on: January 08, 2024

Impact Score: 8.15

Arxiv code: Arxiv:2401.03737

Summary

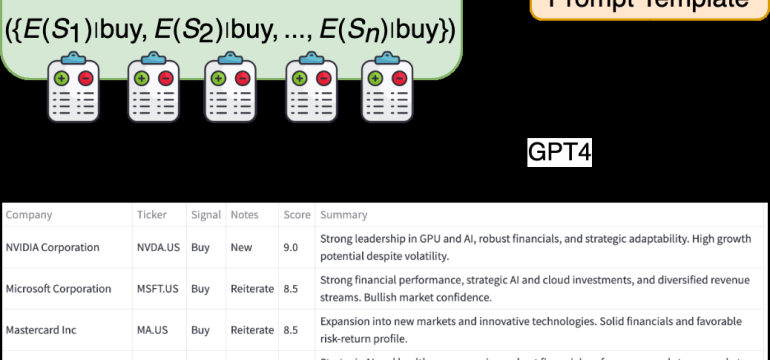

- What is new: Introducing MarketSenseAI, a GPT-4-based framework using advanced reasoning for stock selection, unique in its integration of Chain of Thought and In-Context Learning methodologies.

- Why this is important: The need for an AI system that can emulate financial investment team decision-making processes, analyze diverse financial data, and provide reliable investment signals.

- What the research proposes: MarketSenseAI framework leveraging GPT-4, capable of data analysis and generating actionable investment signals with explanations.

- Results: MarketSenseAI outperformed the benchmark index by 13%, achieving up to 40% returns, with a risk profile comparable to the market.

Technical Details

Technological frameworks used: MarketSenseAI, GPT-4-based AI framework

Models used: Chain of Thought, In-Context Learning

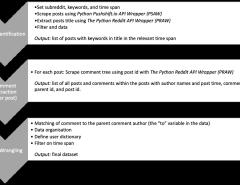

Data used: Market price dynamics, financial news, company fundamentals, macroeconomic reports

Potential Impact

Financial markets, investment firms, AI-driven analytics companies

Want to implement this idea in a business?

We have generated a startup concept here: InsightAI Finance.

Leave a Reply